Transform your dojo. Grow your profit.

Change your life.

We help martial arts school owners transform their dojos into profitable 6 and 7 Figure businesses.

Watch Video

IS THIS FOR ME?

DO YOU STRUGGLE WITH...

Generating Consistent Leads

We can help fill your school with new leads that become students.

Adding New Student Enrollments

Our methods help school owners easily convey the value of their programs and enroll more students.

Keeping Students

Let us show you how we stop cancellations in their tracks and keep students training for years.

Expanding Programs

Learn our signature method to expand your programming and profits.

Developing Current and Future Staff

Teach the classes you want when you want and build a reliable team that loves where they work.

Scaling Profit

Keep more of the money you generate and build wealth for your family and your team.

The 7 Figure Dojo Difference

Join the program transforming martial arts schools around the world.

ABOUT THE 7 FIGURE DOJO PROGRAM

Here's what's inside...

Are you a martial arts school owner looking to inspire your students and reach new heights of success in your business?

You've come to the right place.

Our programs are designed to help you tap into your full potential as a leader and business owner, and reach new levels of financial success.

With the help of our experienced team of coaches and industry experts, you'll learn strategies for attracting and retaining students, streamlining your operations, and maximizing your profits.

You have the power to make your martial arts school thrive - join the 7FD family today and let us help you achieve your dreams.

Together, we can create a bright future for your school and your students.

Speak to one of our Program Advisors today and start building the future you deserve.

Ready to get started?

Pricing

7 Figure Dojo Secrets

Facebook Group Community

FREE

Support and guidance for martial arts business owners

Ask for advice and share experiences across the industry

Low cost marketing to grow your dojo

Training sessions with industry experts

7 Figure Dojo Framework Course

Discover the same framework that led to 7 Figures in our own martial arts school

only $4.97

During Pre-Sell ONLY!

7 Figure Dojo Framework Course to build your own 7 Figure Dojo

Breakdown of our High Value-High Profit Enrollment System

BONUS: 7 Figure Dojo Local Marketing Trainings

BONUS: 7 Figure Dojo Sales Trainings

BONUS: 3 Dojo Case Studies

7 Figure Dojo Program

Business Coaching

Request Info

7 Figure Dojo Success Academy for Owners

1 o 1 Program Pricing Refinement

Done-For-You Lead Generation

Done-For-You Phone Call and Texting Scripts

Done-For-You Objection Handling Scripts

Weekly Leadership, Sales and Marketing Masterclasses for You and Team

Client Only Slack Communication Channel

Unlimited 1:1 Coaching

Meet Our Founder

Jennifer Waters

Jennifer and her family took their small martial arts school from 50 students and a few thousand dollars in revenue to an impressive $1,000,000 in just under 4 years.

After hitting the 7 Figure mark for over a decade, the pandemic of 2020 challenged martial arts schools all over the world.

During this uncertain time, school owners from around the globe reached out to Jennifer and her father, Tommy Seigler, for guidance on how to not just survive, but thrive under these difficult circumstances.

This inspired the creation of the 7 Figure Dojo program for martial arts school owners.

Now, Jennifer and her team help martial arts school owners from around the world transform their dojos into profitable businesses that provide a legacy for their families and students.

Through their hard work and dedication, these school owners are able to turn their passions into profitable, successful ventures.

TAKE A FRESH LOOK AT HOW WE DO BUSINESS

CLIENT TESTIMONIALS

It really works!

We have clients across the globe getting new students and growing their profit in every style you can imagine:

Karate

Brazilian Jiu-Jitsu

Krav Maga

Tae Kwon Do

Muy Thai

Sambo

Kung Fu

Filipino Arts

Shotokan

Kempo

Submission Grappling

Aikido

and the list goes on...

Working with martial arts schools across the world!

We Started a YouTube Channel

Our goal was simple. Provide school owners with an easy way to grow their martial arts school and provide real advice that all the "guru's" keep behind expensive coaching.

TIPS & UPDATES

Recent Articles

KNOW YOUR FLOW TO GROW YOUR FLOW

KNOW YOUR FLOW TO GROW YOUR FLOW – MARTIAL ARTS BUSINESS GROWTH TIPS

A large number of struggling businesses transform their finances with a few simple ingredients. An equal number are also forced to shut down due to poor flow. The key to getting your business’s finances in order is to know your flow, and ultimately, grow your flow. Sales and systems sensei Jennifer Waters shares her personal method of managing finances and the tips, tools and techniques which helped her grow her flagship school.

The base of the blueprint is to dig into two aspects: First, what are your personal needs inside of your household, and second, what are the business expenses. The end goal is to work together and manage both. Most people are not taught what they should be doing as a business owner, they’re only taught what they should be doing if they work for someone.

First aspect is to calculate your bottom line expenses, that is, how much money that you absolutely need to exist and survive as a family unit. This includes your mortgage, utilities, rent, groceries, and how much you are spending on gas, vehicle payments, insurance and such. After listing down these essential expenses, next is to look at your savings. Work on your savings to try and put together an emergency fund in place, for any unprecedented catastrophic events such as your car needing a repair or you’re in need of buying a new washer. So that in the case of any such happening, you have some cushion there and are not stuck with taking out a loan to take care of those things. You can start it off with one month, then try to take it to three months, then get it to six months. After managing your savings you can further move on to think of other things such as investing or giving funds to friends and family for help. But the most important thing is to take care of yourself first so that you are in a good position to take care of other people. It is very essential that you get your personal finances in order before you start digging into the business finances.

One very helpful tool to have is a budgeting software – one that connects directly to your credit cards and bank accounts, and syncs all the transactions together. Some recommendations are ‘Mint’, ‘Ramsey Solutions’ and Water’s personally preferred one, ‘You Need A Budget’.

Having a budget gives you the advantage of categorizing your expenses and managing your financial goals, and a budgeting software helps you manage financial goals depending on the date of the month or the entirety. For example if you wanted to save money for Christmas, you can set a target goal for December which is a monetary goal. Or if you need to have a certain amount of money in a category for paying a bill that is due by a certain date, you can set the due date to make sure you’re reaching that goal every month.

Next, for managing your business finances, you basically repeat what you did for your personal finances. The easiest way to go about it is to go through your bank account statement and sort it all into different categories with some different colored highlighters or so. Creating different categories such as rent, utilities, payroll, etc. helps you get an idea of the average expenses of the month, and then you calculate it for the past three months, so you can see what on average you are spending on your business. This helps you calculate your break-even, which means how much cash you need to bring in per month to keep yourself from going into debt to cover the business expenses. It has to include all your expenses including any loan payments that you are making, and that is your break-even. Once you hit that break-even line, everything above that is what you make in profit. However, before taking home your profit, you need to make sure you create an emergency fund for your business as well in the unfortunate case of having a bad month in business.

If you are struggling with managing these and could use the help of a mentor to guide you through these steps, Jennifer Waters runs a 7-Figure Dojo program that gives you the required mentorship, guidance and the tools to make the whole process a whole lot easier, and you can check out her program on the website www.7figuredojo.com.

Check out this Video!

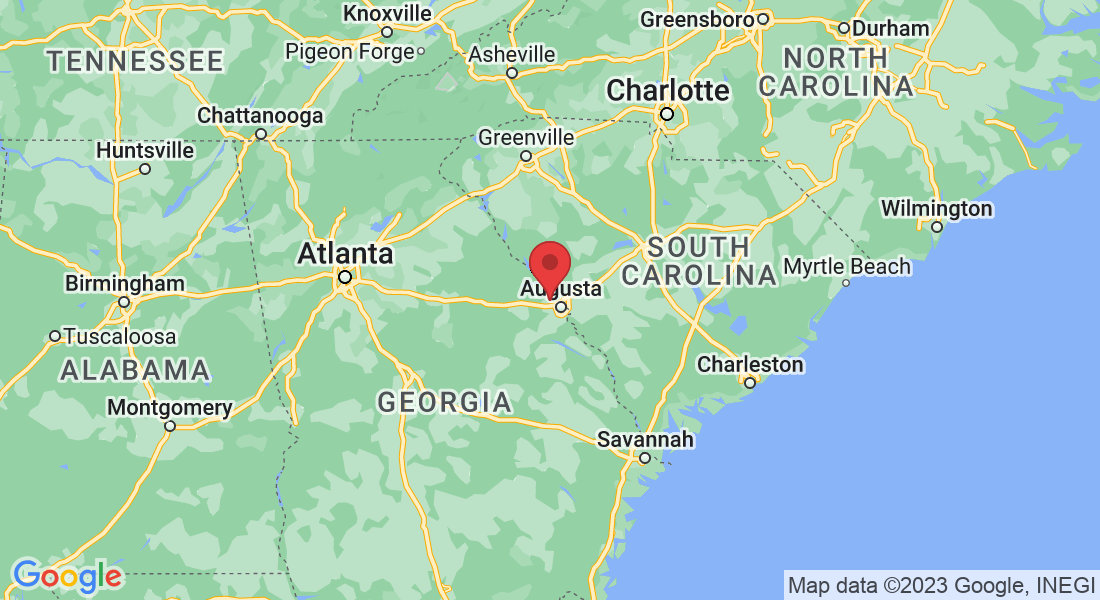

Get In Touch

Message Us - start chatting now

Call Us:

+1 706-223-0430

Address

Office: 4150 Washington Road, Evans GA 30809

Assistance Hours

Mon –Friday 8:00AM - 5:00 PM EST

Saturday & Sunday – CLOSED

Copyright Braven LLC 2022. All rights reserved.

4150 Washington Road, Suite 4, Evans GA, USA 30809